Build and run your own open data fintech ecosystem.

The Caspian One Open Data platform enables financial institutions to build and run their own fintech ecosystem to create personalized end user experiences and outcomes, attracting and retaining account holders and driving new revenue streams.

Security.

Securely and compliantly share customer data in an Open Banking environment. Ensure robust data privacy and secure data access with comprehensive Financial Grade API (FAPI) security measures - while adhering to regulatory requirements.

Choice.

Harness the potential of Open Data to build and deliver data-enriched products and services that can be underpinned by AI and machine learning. Stay unique with an open platform that enhances your USPs, responds to the market and enables competitive differentiation.

Control.

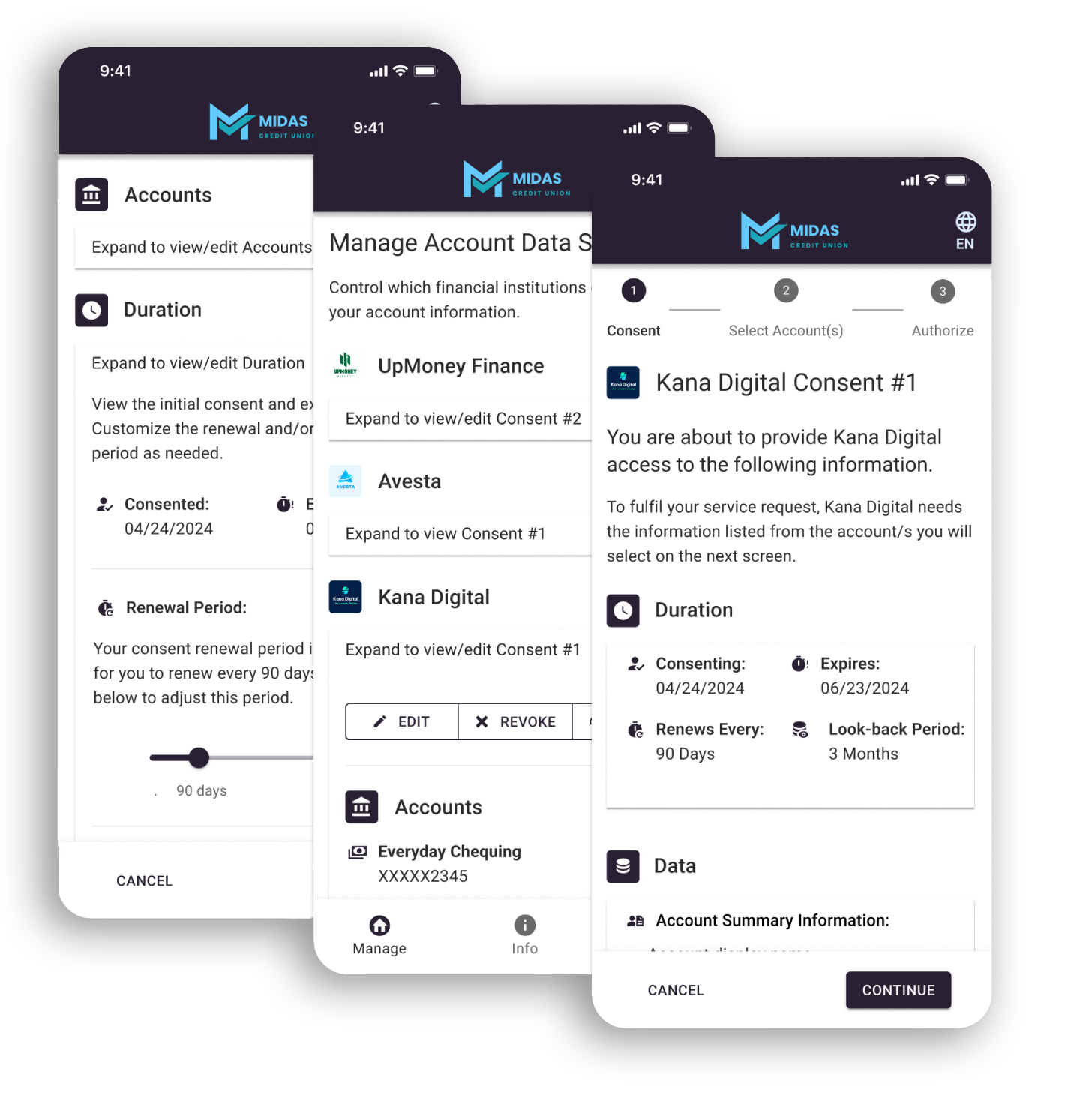

Stay in control with a flexible platform designed to suit you and your customers via a range of simple, adaptable, and cost-effective deployment options. Integrate plug-in FinTech partners to create your own engaging digital customer journeys.

Empower your customers with access to new innovative services and financial management.

Caspian One Open Data has a fully open and federated architecture that empowers your financial institution to develop Open Data capabilities tailored to your specific needs and those of your customers. This enhances your

brand identity and relevance, ensuring you

remain responsive to your customers' needs.

Credit Unions and Community Banks

Large Financial Institutions

It's not just about meeting the demand or regulatory mandates, it's about elevating your financial institution's products and services.

$57B

The value of open banking transactions worldwide reached

57 billion U.S. dollars in 2023

5.3

The average consumer in the U.S. has a total of 5.3 accounts across financial institutions

13,000

There are over 13,000 FinTech companies operating in US.

Customization

& flexibility.

Caspian One's solution marks a significant departure from legacy platforms and aggregators catering to financial markets. While those platforms adapted to meet screen-scraping demands, Caspian's platform stands out as a purpose built, highly secure API-driven data-sharing ecosystem.

It promotes the structuring of multiple partnerships with a platform utilizing global best practices for scaling data-sharing ecosystems and fostering parallel innovations.

A scalable solution built for any financial institution size.

Caspian Evolve

Evolve is designed to help credit unions and community banks navigate the complex world of open data.

Caspian Evolve empowers you to leverage the power of open data. Its user-friendly platform allows you to develop and deploy open banking capabilities quickly and securely, tailored to your unique needs. By joining a shared ecosystem, you can reduce costs, accelerate innovation, and compete with larger financial institutions right away.

Caspian Nexus

Nexus helps large FI’s deploy open data solutions faster, accelerate digital transformation, and innovate new services.

Caspian Nexus provides a comprehensive enterprise solution for open data. Its federated architecture promotes scale, performance and interoperability across the enterprise. Nexus provides simplified integration with existing infrastructure and empowers a large bank to deliver a wider range of innovative financial products and services.

At Caspian One Open Data.

We have over 20 years of experience partnering with and delivering to Tier 1 & 2 financial institutions across retail and capital markets - supporting information providers with technology and expertise.

Caspian One brings over 15 years of experience to the Canadian market. Through partnerships with Fortune 500 IT leaders and financial institutions, we've gained a deep understanding of market requirements, allowing us to deliver bespoke solutions at scale.

Commitment

to Partnership.

At Caspian One, we believe in the power of collaboration. Through strategic partnerships with leading fintechs and established global powerhouses like DXC Luxoft, our customers directly benefit from cutting-edge technology, robust infrastructure, as well as new and highly desired use-cases.

The Latest.

-

“By leveraging the Caspian One Open Banking platform, we can offer our members access to leading technology and enhanced banking experiences.”

Darrell Jaggers, CIO and CTO

- FirstWest Credit Union -

“The Caspian One Open Banking platform aligns with our commitment to innovation and excellence in financial services."

Greg Dyck, Chief Digital and Information Officer - Prospera Credit Union

-

“Collaborating with Caspian One allows us to leverage open banking technology at scale and enhance the digital experiences of our members.”

Matthew Seagrim, Chief Digital & Marketing Officer - Meridian Credit Union